Here is the result in plain text:

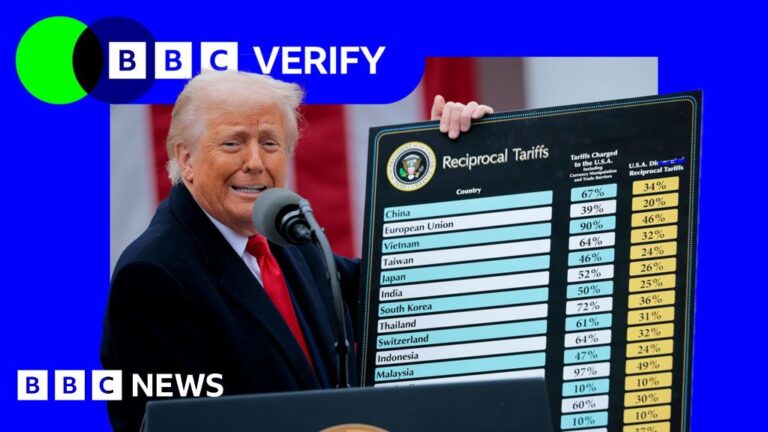

President Trump is poised to move forward with sweeping tariffs on foreign steel and aluminum on Monday, re-upping a policy from his first term that pleased domestic metal makers, but hurt other American industries and ignited trade wars with allies on multiple fronts.

The 25 percent tariffs that the president said he would impose on foreign steel and aluminum will be welcomed by domestic steelmakers, who argue they are struggling to compete against cheap foreign metals.

But the tariffs will invite plenty of controversy. They are likely to rankle America’s allies, like Canada and Mexico, who supply the bulk of U.S. metal imports. And they could incite retaliation on U.S. exports, as well as pushback from American industries that use metals to make cars, food packaging and other products.

Mr. Trump has imposed global tariffs on steel and aluminum before. In his first term, the president levied tariffs on foreign steel and aluminum globally, angering allies like Mexico, Canada and the European Union.

The United States imports very little steel or aluminum directly from China, since Chinese exports have long been blocked by a variety of anti-dumping and subsidy tariffs.

American steelmakers welcomed the tariffs. In a statement Sunday, Kevin Dempsey, the president of the American Iron and Steel Institute, said that the group welcomed Mr. Trump’s “continued commitment to a strong American steel industry, which is essential to America’s national security and economic prosperity.”

A study by the nonpartisan International Trade Commission found that the steel and aluminum tariffs increased the price of imports, and encouraged consumers of steel and aluminum to buy more American metals as opposed to foreign ones.

Some in the U.S. metal industries say that the levies have not gone far enough. They argue that metal imports from other countries, like Mexico, started to surge shortly after tariffs were rolled back as part of the U.S.-Mexico-Canada Agreement signed in 2020.

Mr. Mottl runs Atlas Tool Works, a precision manufacturer near Chicago, which buys steel and aluminum to make products for the aerospace, medical and telecom industries, among others. He said that he initially saw a spike in steel and aluminum prices from the tariffs, but then prices fell back and new sources of supply cropped up.

In response to the metal tariffs, for example, the European Union imposed a 25 percent tariff on American whiskey. The American and European governments negotiated a deal to temporarily suspend those tariffs, but it is set to expire soon.

Source link