After three days of global market turmoil not seen since the early days of the Covid-19 pandemic, stocks in Asia regained a measure of calm on Tuesday despite little let up in the escalating trade tensions caused by President Trump’s tariffs.

Before markets opened in China, the government unleashed a series of measures to stabilize stocks. In turn, share prices in Hong Kong, a day after plunging 13.2 percent, rose 2 percent. Benchmarks in mainland China ticked higher, recovering from big declines the day before.

In Japan, the Nikkei 225, a key benchmark in Japan, gained 6 percent, recouping a portion of the previous days losses. The uptick in sentiment followed comments made on Monday by Treasury Secretary Scott Bessent, who said he would soon begin discussions with the Japanese government regarding tariffs.

The Kospi index rose in South Korea rose about 1.5 percent.

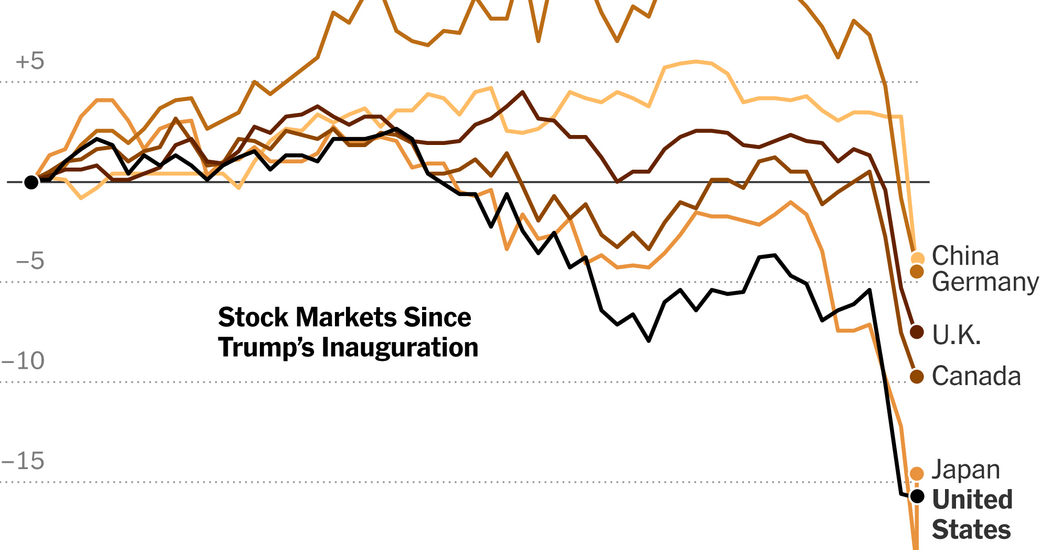

Markets around the world were unmoored last week by Mr. Trump’s announcement of broad new tariffs — a base tax of 10 percent on American imports, plus significantly higher rates on dozens of other countries. Countries have responded with tariffs of their own on U.S. goods, or with threats of retaliation. China retaliated forcefully on Friday, matching a new 34 percent tariff with one of its own on many American imports.

In the United States on Monday, the S&P 500 fell 0.2 percent after tumultuous trading that at one point pulled the benchmark into bear market territory, or a drop of 20 percent or more from its recent high. S&P futures, indicating how markets might perform when they reopen for trading on Wednesday in New York, were 1.5 percent higher.

Wall Street executives and analysts are growing increasingly worried that escalating trade tensions could do lasting damage to the global economy.

“The quicker this issue is resolved, the better because some of the negative effects increase cumulatively over time and would be hard to reverse,” Jamie Dimon, the chief executive of JPMorgan Chase, wrote in his annual letter to shareholders on Monday. Some bank economists are already forecasting that the economy will slip into recession later this year.

The 10.5 percent drop in the S&P 500 on Thursday and Friday was the worst two-day decline for the index since the onset of the coronavirus pandemic in 2020.

With the new higher-rate tariffs set to go into effect on Wednesday, Mr. Trump has remained unrelenting on his trade stance. On Monday he issued a new ultimatum to China to rescind its retaliatory tariffs on the United States, or face additional tariffs of 50 percent beginning Wednesday.

But China showed on Tuesday that it is not relenting.

Several government departments and government-owned enterprises issued statements and pledged to “maintain the smooth operation of the capital market.” And the People’s Bank of China, the country’s central bank, vowed to support Central Huijin Investment, the arm of China’s sovereign wealth fund that said it was increasing its holdings of stock funds.

In addition, seven companies affiliated with China Merchants Group, a large corporation owned by the central government that trades in Hong Kong, said they would accelerate a plan to buy back some of its shares, a move that typically lifts stock prices.

The moves by what is known as China’s “national team” were reminiscent of efforts Beijing took during a market crisis in 2015.

At the time, the Chinese government’s efforts to shore up stock prices came after its own misjudged steps to boost and then cool prices. This time, Beijing’s intervention appears to chime with a strategy by the Chinese leader, Xi Jinping, of presenting his government as a pillar of steady calm against the global economic turbulence unleashed by Mr. Trump’s tariffs.

Christopher Buckley and River Akira Davis contributed reporting.

Source link